A Closer Look At What Others Spend On Food

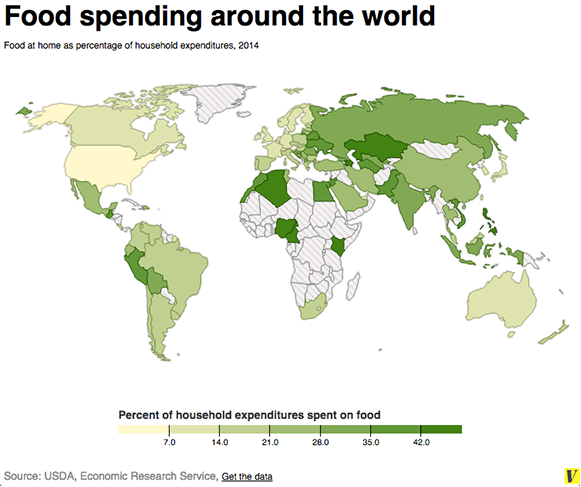

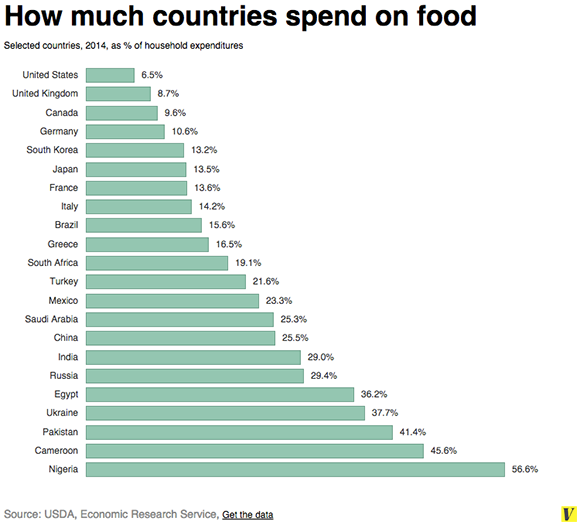

I think it’s interesting to see how much other nations are spending on food. If you look at the graphics I’ve included below from the USDA, you can see the United States spends a smaller percentage than any other nation. To clarify, these are percentages. In an absolute sense, the United States spends more per household on food consumed at home ($2,390 per year) than, say, Nigeria ($1,343) or Russia ($1,935). But because Americans are richer, food still makes up a much smaller portion of their budgets. So as countries get richer, we find that they start spending more of their money on other things — like health care, or entertainment, or alcohol. South Koreans spent one-third of their budget on food in 1975; today that’s down to just 13 percent.