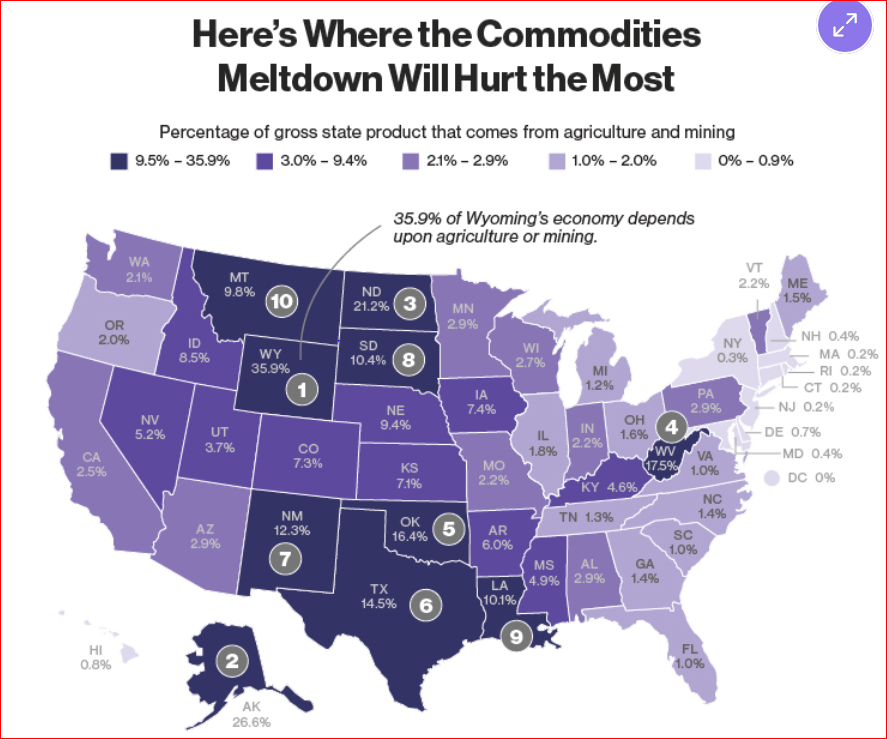

These 10 States Will Be Hurting the Most After the Commodities Meltdown

In the brutal commodities meltdown, all U.S. states are not created equal.

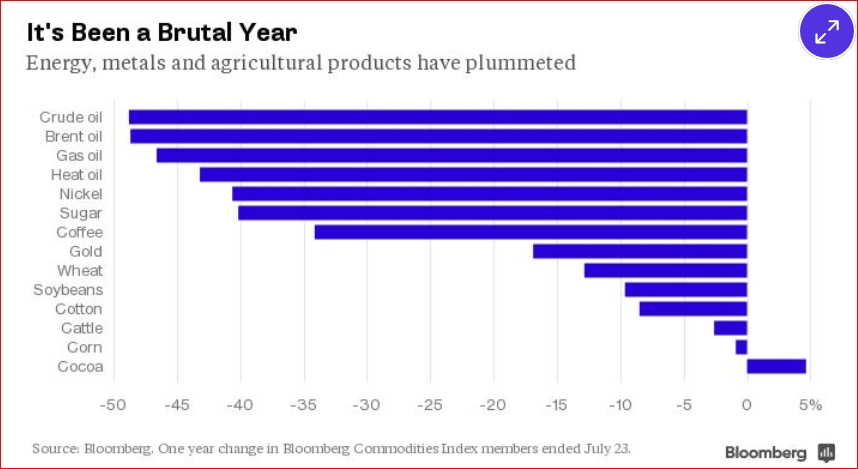

In fact, the impact has been vastly different. The Bloomberg Commodity Index last week reached a 13-year low and has plunged 61 percent since its peak in 2008. That matters a lot in, say, Wyoming, Louisiana, Texas and Nebraska. Not so much in New Jersey or Massachusetts, for example. The map below shows the top 10 states with the greatest exposure as measured by mining and agriculture’s share of the economy in 2014. The darker the color, the more the state’s economy is at risk.

Wyoming is home to most of the top producing coal mines in the U.S. Its mining and agriculture industries generated 36 percent of its economic output in 2014, more than any other state, according to Moody’s Analytics’s calculations using Commerce Department data.

The top nine states on the map got at least 10 percent of their gross state product from energy, mining and agriculture last year: Wyoming, Alaska, North Dakota, West Virginia, Oklahoma, Texas, New Mexico, Louisiana and South Dakota. Another six got more than 7 percent, compared to just 3.9 percent for the U.S. as a whole.

New Jersey, Massachusetts, New York, Rhode Island and Connecticut have almost none of their economies in those industries, just 0.3 percent or less.

A year ago, Federal Reserve policy makers and many private economists viewed falling oil prices as an economic boom that would boost consumer confidence and spending. While there’s been some evidence of that in restaurant sales for example, it’s been partly offset by the slowdown in mining and farming that has reduced employment in a checkerboard of states.

The commodities collapse has cut monthly employment gains in the U.S. by around 50,000 a month this year, estimates Mark Zandi, Moody’s chief economist in West Chester, Pennsylvania.

“Growth has slowed sharply in the commodities-producing parts of the country, most significantly in the energy sector,” Zandi said. “The very heady rates of growth of recent years have given way to pedestrian growth and in some places no growth at all.”

Farming has seen a less significant loss of jobs, but “we will see much weaker income numbers in agriculture-producing regions,” he said.

That’s also reduced wage growth in those states, Goldman Sachs Group Inc. economist David Mericle wrote in a report July 20.

While Federal Reserve Chair Janet Yellen has said there are tentative signs wages are picking up, “a counterpoint to this generally encouraging picture is that the shale states have seen major setbacks recently,” Mericle wrote.

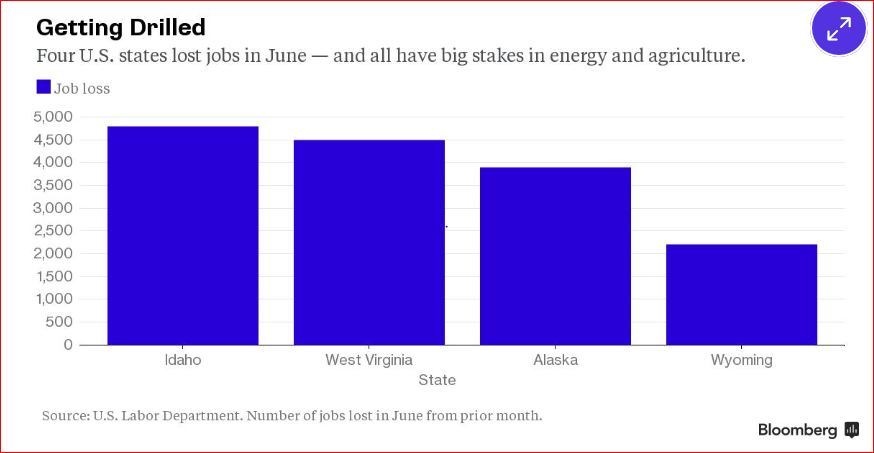

In June, there were job losses in Wyoming, West Virginia, Alaska and Idaho, states that all had more than twice as much of their economies tied to farming and mining than the […]